Preparing Your Supply Chain for Q4 Rush Without Overstocking

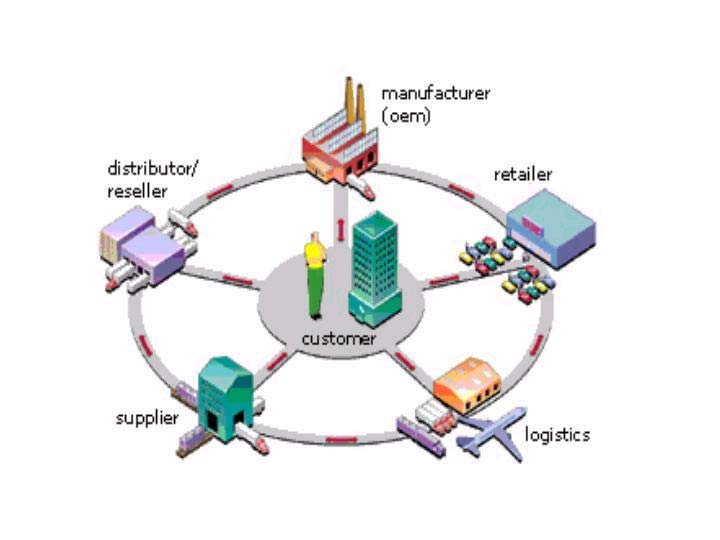

Q4 can make or break your year on Amazon and other marketplaces. While increased demand during Black Friday, Cyber Monday, and the holiday season creates massive revenue opportunities, it also exposes sellers to costly risks—excess inventory, long-term storage fees, cash-flow strain, and stranded stock well into the new year. The key to winning Q4 isn’t simply stocking more inventory—it’s building a supply chain that is flexible, data-driven, and responsive.

This guide walks through how to prepare your supply chain for Q4 demand without overcommitting inventory, helping you scale profitably while protecting margins.

Why Q4 Supply Chain Planning Fails for Many Sellers

Many brands approach Q4 with aggressive inventory purchases based on optimism rather than precision. Common mistakes include:

Forecasting based on last year’s peak without adjusting for pricing, ad spend, or category shifts

Ordering too early or too late due to supplier lead-time miscalculations

Ignoring inbound delays and fulfillment center congestion

Failing to plan exit strategies for leftover inventory

Amazon’s storage limits and aged inventory fees make these mistakes expensive. A smarter approach blends forecasting, flexible fulfillment, and staged inventory commitments.

Start With Demand Forecasting That Reflects Reality

Accurate forecasting is the foundation of a healthy Q4 supply chain. Instead of relying on top-line growth assumptions, focus on SKU-level performance trends.

Actionable forecasting tips:

Analyze Q4 sales from the prior year by week, not just by month

Adjust projections based on pricing changes, promotions, and advertising spend

Account for new ASINs that may cannibalize existing products

Factor in demand spikes tied to deal events

Inventory planning tools inside Seller Central can provide useful guidance when paired with historical sales data and realistic sell-through targets.

Order in Phases Instead of One Large Commitment

One of the most effective ways to avoid overstocking is staggered purchasing. Instead of placing one large Q4 order, break inventory into planned phases tied to actual sales velocity.

Best practices for phased ordering:

Place an initial order that covers early Q4 demand

Schedule follow-up production or reorders based on real-time sell-through

Maintain safety stock only for top-performing SKUs

Avoid speculative inventory for slow or highly seasonal variations

This approach preserves cash flow while allowing you to scale into demand instead of guessing upfront.

Build Flexibility Into Your Fulfillment Strategy

Relying solely on FBA during Q4 can be risky. Inbound delays, receiving backlogs, and storage restrictions can disrupt even well-planned inventory strategies. Diversifying fulfillment creates a safety net.

Smart fulfillment options include:

Holding reserve inventory at a third-party logistics provider for quick replenishment

Using FBM as a backup when FBA inventory is constrained

Splitting inventory across multiple fulfillment locations

Flexible fulfillment ensures you can continue selling even when one channel slows or becomes congested.

Plan Inbound Shipments Backwards From Key Q4 Dates

Q4 success depends on when inventory becomes sellable, not when it leaves your supplier. Receiving delays in October and November are common, so planning must start with target availability dates.

Key planning checkpoints:

Identify inbound cutoff dates for Black Friday and Cyber Monday

Build buffer time for carrier delays and fulfillment center congestion

Use smaller, more frequent shipments when possible

Avoid sending all inventory to a single fulfillment center

Backwards planning reduces the risk of missing peak selling windows.

Use Inventory Age Reports as a Q4 Risk Indicator

Inventory Age Reports are not just cleanup tools—they are early warning signals for Q4 risk. If you are carrying aging inventory before peak season, adding more units increases exposure.

How to use inventory age data proactively:

Identify SKUs already trending toward higher age brackets

Reduce or pause reorders on slow-moving variants

Bundle, discount, or liquidate aging inventory before Q4

Prioritize replenishment dollars for fast-turning ASINs

Clearing risk ahead of Q4 creates room—both financially and physically—for inventory that actually drives revenue.

Align Promotions With Inventory Reality

Promotions should be inventory-driven, not calendar-driven. Running deals without sufficient stock leads to lost momentum, while over-promoting slow SKUs creates post-holiday excess.

Effective promotion alignment:

Match promotions to products with strong sell-through

Avoid aggressive discounts on items with long replenishment lead times

Use promotions strategically to manage inventory depth

Well-aligned promotions support revenue growth without creating inventory problems in January.

Build a Post-Q4 Exit Strategy Before Q4 Begins

The strongest Q4 supply chains plan for January before December arrives. Every SKU should have a defined post-holiday path.

Exit strategy options include:

Planned price adjustments after December 25

Bundling excess inventory with faster-moving products

Liquidation or off-channel clearance

Removal or storage reduction strategies before fee increases

Having these plans in place prevents reactive decision-making when sales slow and storage costs rise.

Final Thoughts: Q4 Success Is About Control, Not Excess

Preparing your supply chain for Q4 isn’t about stocking as much inventory as possible—it’s about maintaining control over demand, cash flow, and operational risk. Brands that win Q4 forecast accurately, order strategically, diversify fulfillment, and stay responsive to real-time data.

When your supply chain is built for flexibility, you don’t just survive the Q4 rush—you scale through it profitably and enter the new year positioned for growth instead of cleanup.